32+ mortgage deduction new tax plan

Web For starters the standard deduction increased from 12700 to 24000 for married couples and from 6350 to 12000 for individuals. Web Image source.

How The Big 6 Tax Plan Would Downsize The Mortgage Interest Deduction

Single taxpayers and married taxpayers who file separate returns.

. Web For 2021 tax returns the government has raised the standard deduction to. It allows taxpayers to deduct interest paid up to 750000 375000 for married filing. The tax items for tax year 2022 of greatest interest to most.

12000 for single filers 18000 for heads of. New cap at 750k - YouTube Tax plan specified a mortgage interest deduction cap for new home purchases. Web Assuming you refinance a new 30-year mortgage you can deduct 130 th of whatever you paid in points every year.

Web The tax year 2022 adjustments described below generally apply to tax returns filed in 2023. Web This change took effect in 2018. Web Tax Plan - Mortgage Interest Deduction Cap Outdated.

The net cost is even lower if. Taxpayers can only deduct interest on 750000 in home loans. This only applies to homes purchased after December 16 th.

Web If you borrow 34000 over 15 years at a rate of 826 variable you will pay 180 instalments of 37070 per month and a total amount payable of 6672600. The mortgage interest deduction is one of the most popular tax deductions claimed by an estimated 323 million people in 2017. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness.

Web With the Trump tax plan you can take an 18000 deduction for a new car the first year you own it. Single or married filing separately 12550 Married filing jointly or qualifying widow er. Homeowners who bought houses before.

However higher limitations 1 million 500000 if. Web An increase to the standard deduction nearly doubled the total amount taxpayers can claim. You will get money back from the.

12950 for tax year 2022. Web Under certain conditions you can deduct the mortgage interest you pay on your mortgage from your taxable income in Box 1 on the tax return. The new limits are.

Web Standard deduction rates are as follows. Web Mortgage interest is currently tax deductible up to the total amount of interest paid in any given year on the first 750000 of your mortgage or 375000 if. Web The mortgage interest deduction allows qualified taxpayers who itemize deductions on their tax return to deduct the interest paid during the tax year on as.

If you havent deducted all the points by the time. If you buy an SUV or a truck the vehicle is 100 percent. Web The deduction for mortgage interest is available to taxpayers who choose to itemize.

Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. In addition for married. Web If you are in the top bracket under the new Trump tax plan 37 that four-percent mortgage will only cost you a net 252 per year.

Web If the home counts as a personal residence you can generally deduct your mortgage interest on loans up to 750000 as well as up to 10000 in state and local.

Obamacare Optimization Vs Tax Minimization Go Curry Cracker

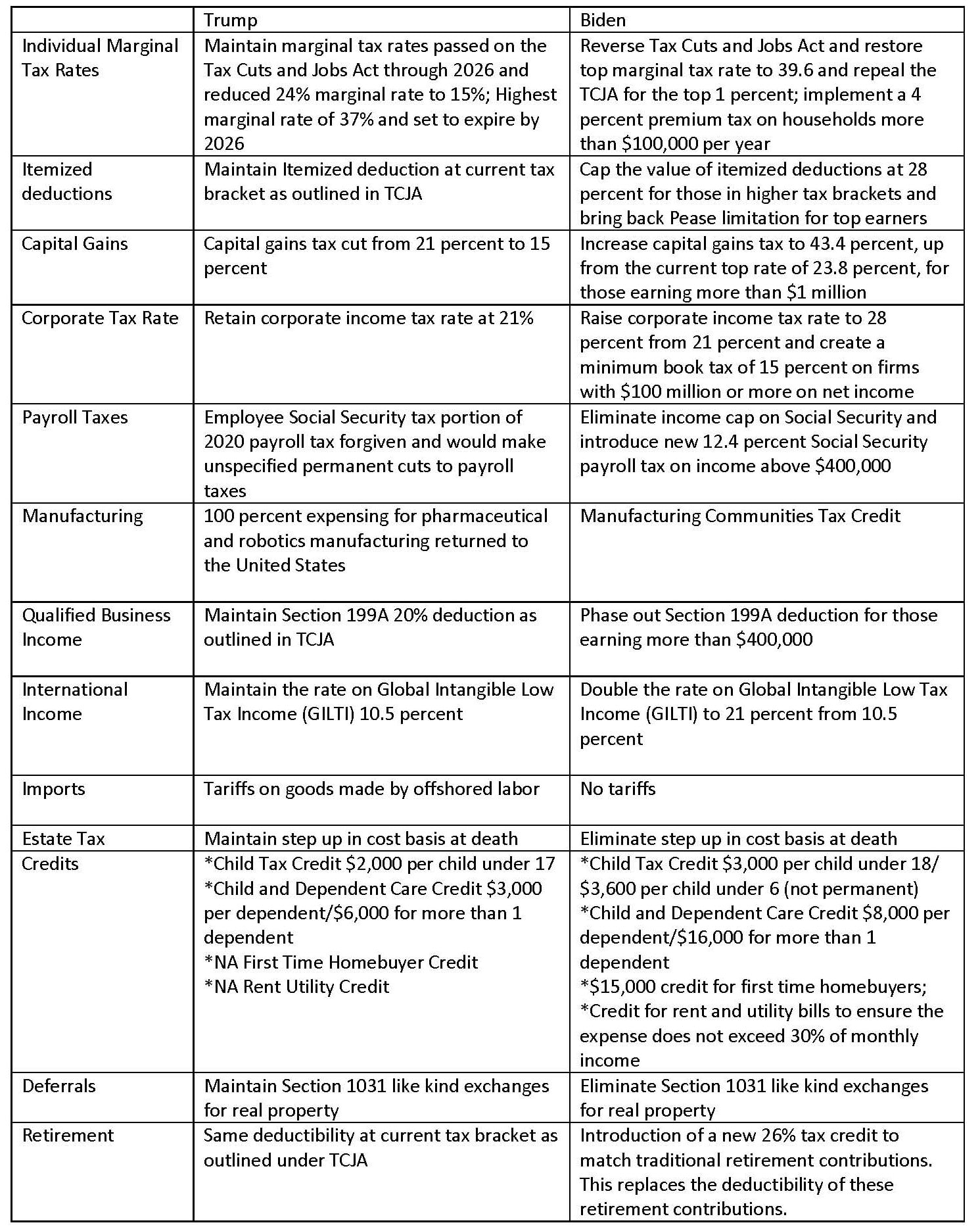

Trump And Biden Tax Plan Comparison Wilke Cpas Advisors Llp

Top Tax Consultants In Papanasam Public Office Best Accounting Services Justdial

Open Esds

How The Tcja Tax Law Affects Your Personal Finances

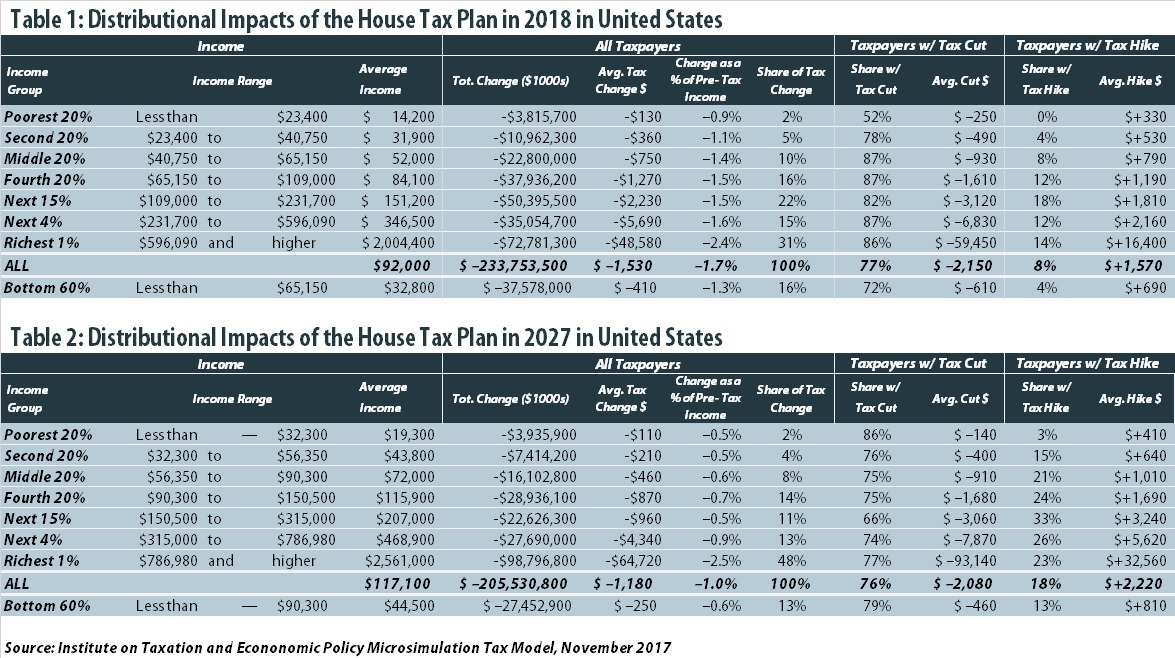

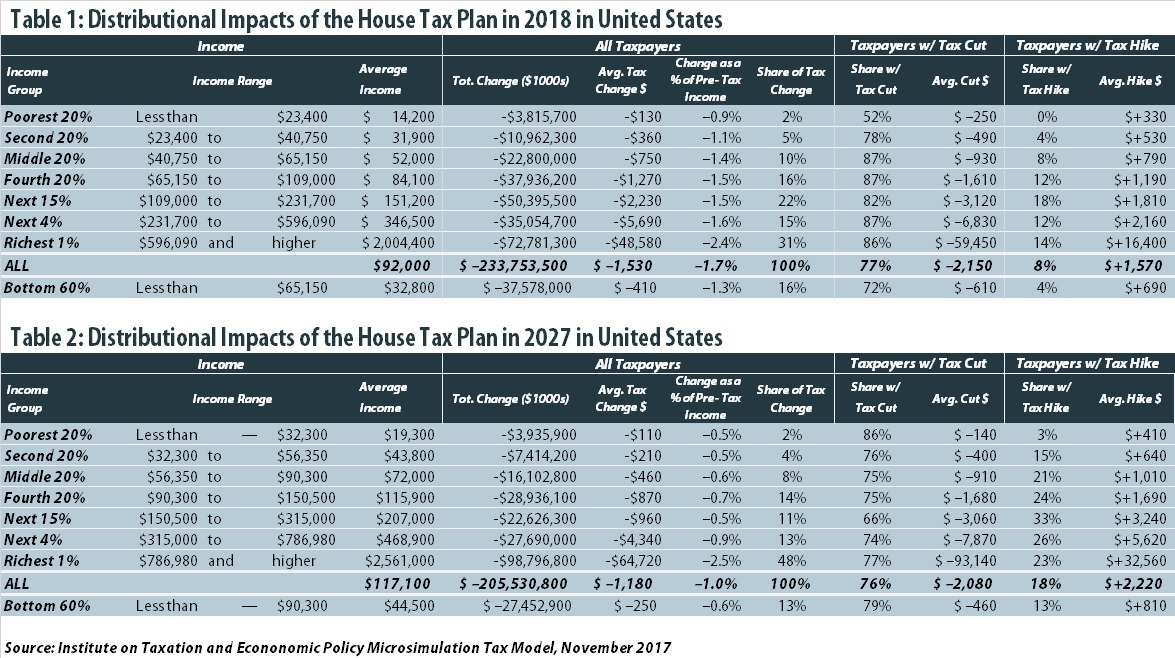

Analysis Of The House Tax Cuts And Jobs Act Itep

Mortgage Interest Deduction Mostly Benefits The Rich End It The Hill

Guide To 2021 Mortgage Tax Deductions The Mortgage Reports

Individual Income Tax The Basics And New Changes St Louis Fed

Fellow Fishes How Much Would My In Hand Salary P Fishbowl

12 Terrible Things About The New Trump Gop Tax Law

Tax Q A Mortgage Interest Deduction And Other Matters Wsj

Gop Tax Plan Cuts Mortgage Deduction In Half Starting Today Cbs News

Fellow Fishes How Much Would My In Hand Salary P Fishbowl

Sec Filing Nkarta Inc

Crain S Detroit Business Sept 5 2016 Issue By Crain S Detroit Business Issuu

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service